Financial crime is everywhere

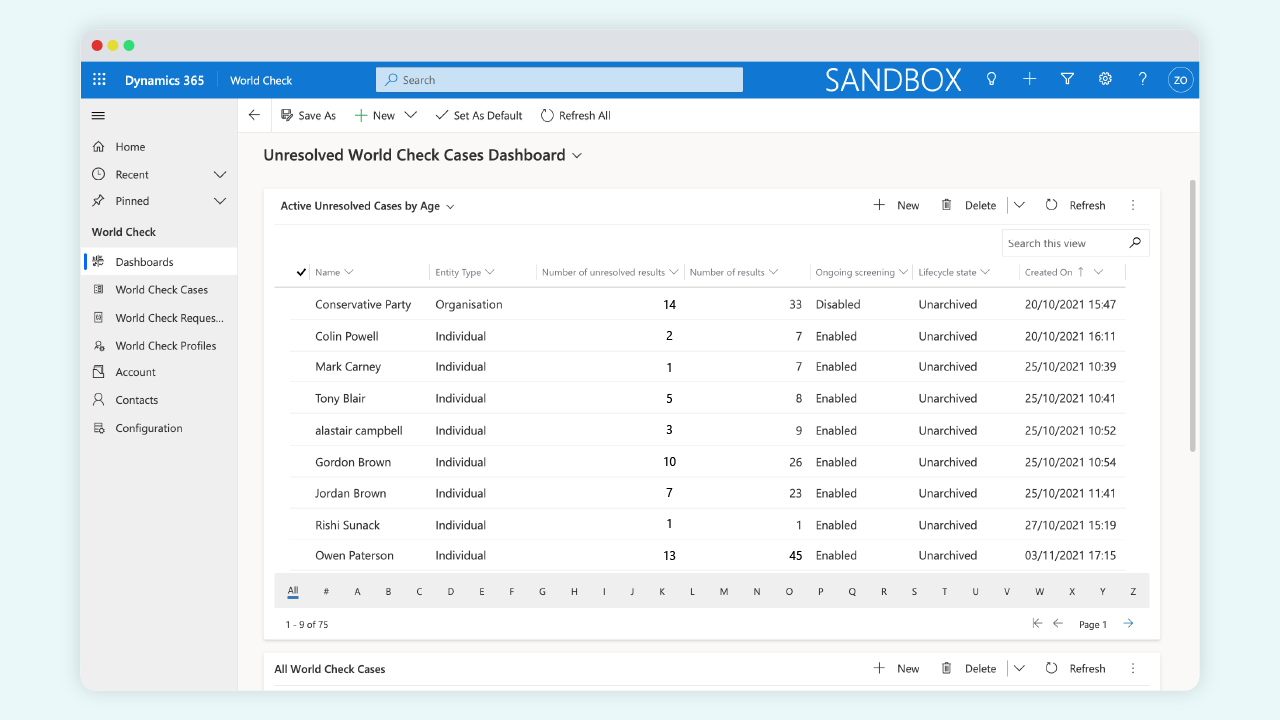

But it is possible to spot. Integrate WORLD-CHECK® from Refinitiv into your existing Microsoft Dynamics 365 platform and run identity checks against known or suspected money launderers, terrorists and other high-risk individuals.

With all your data in one place and access to WORLD-CHECK® from Refinitiv’s global watchlist, reducing risk and complying with AML/KYC regulations has never been so easy.

Know Your Customer (KYC)

Establishing new partnerships with individuals and organisations without a clear picture of their past and current dealings can result in regulatory fines and wider penalties.

But having a robust KYC process in place, that’s more than just a regulatory tick box exercise, helps you fully understand your customers and their needs, as well as safeguards you against the risk of non-compliance.

Mitigate the risk out of your data

Meet your regulatory obligations, make informed decisions and prevent your business being used to launder the proceeds of financial crime or associated with corrupt practices, simply by using WORLD-CHECK® from Refinitiv risk intelligence. It covers:

Politically exposed persons (PEP), close associates, and family members

State owned entities and state invested enterprises

Global sanctions lists

Narrative sanctions (sanctions ownership information)

Global regulatory and law enforcement lists

Iran economic interest (IEI)

UBO

Plus more specific data...

You’re in safe hands with us

We specialise in providing RegTech solutions to financial services companies that seamlessly integrate within their Microsoft Dynamics 365 platforms for more efficient, cost-effective results. WORLD-CHECK® from Refinitiv is just one of a number of industry-leading regulatory compliance technologies we work with. Get in touch to discuss your risk intelligence requirements with us.

Improve your risk management processes

Streamline your KYC screening and due diligence obligations with one stone, a stone that’s used and trusted by the world’s biggest companies for more than two decades. Speak to us today about using WORLD-CHECK® from Refinitiv to protect your business against financial crime and deliver on your due diligence duties.

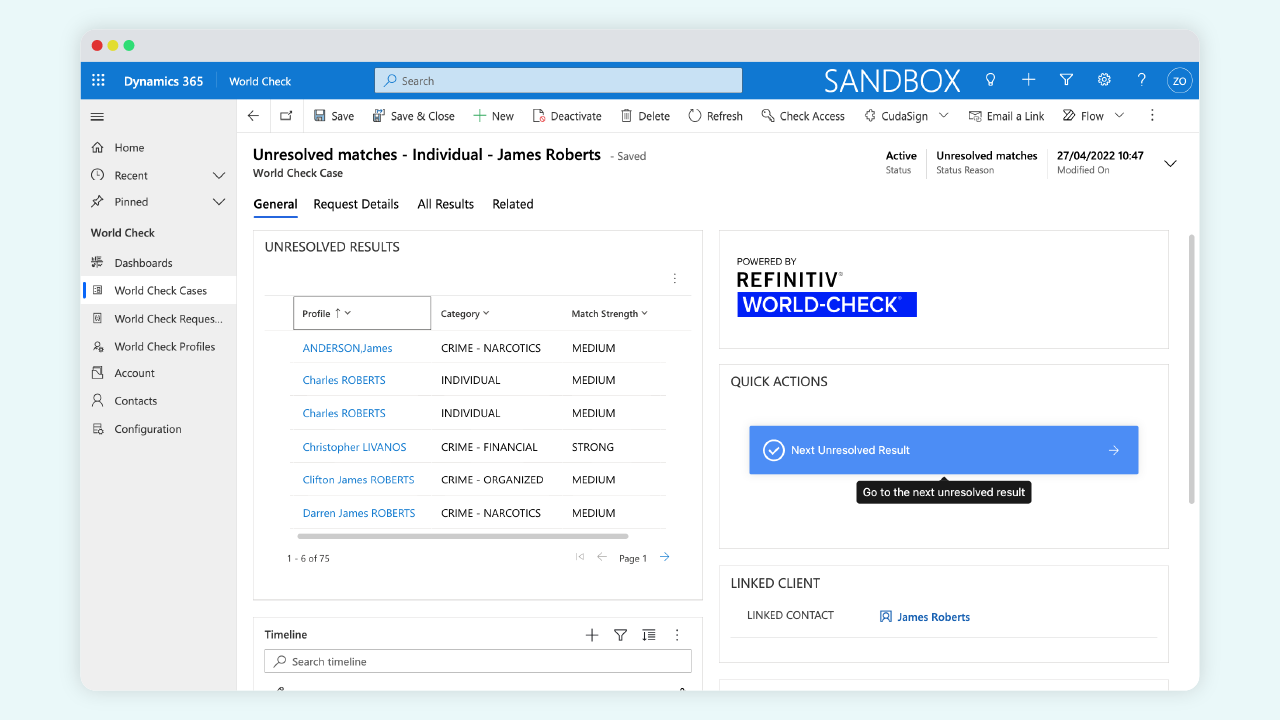

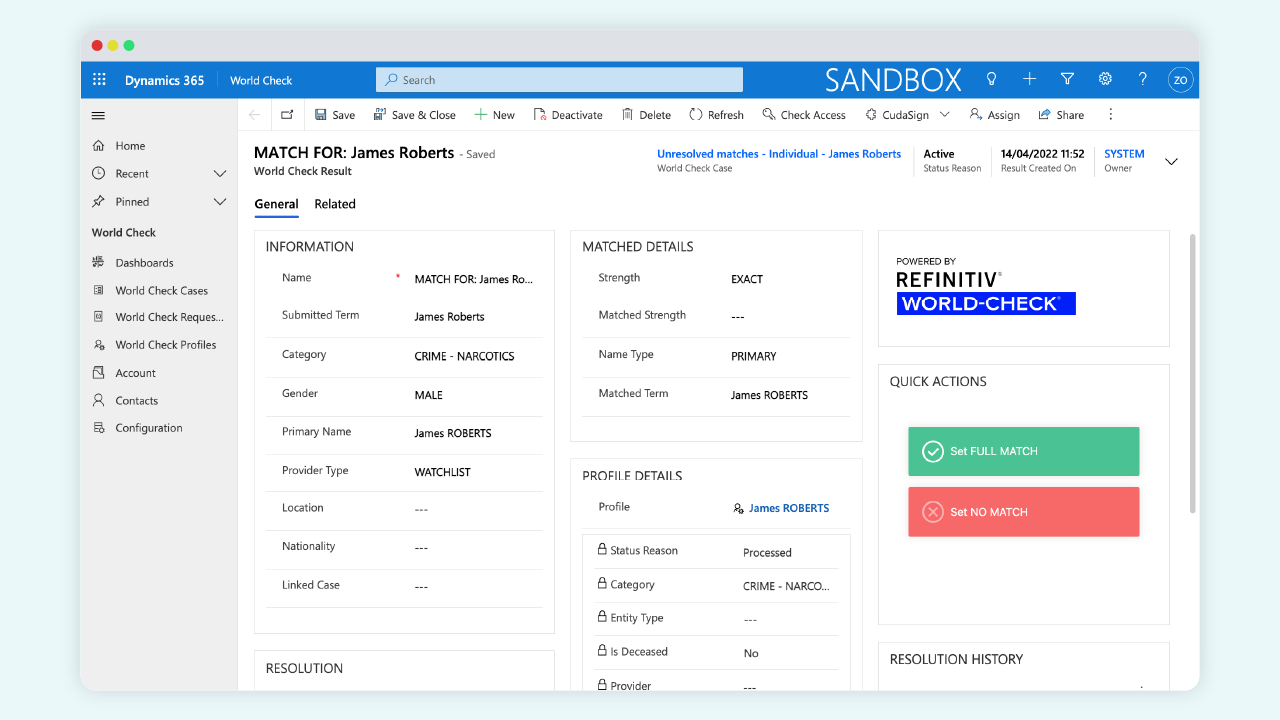

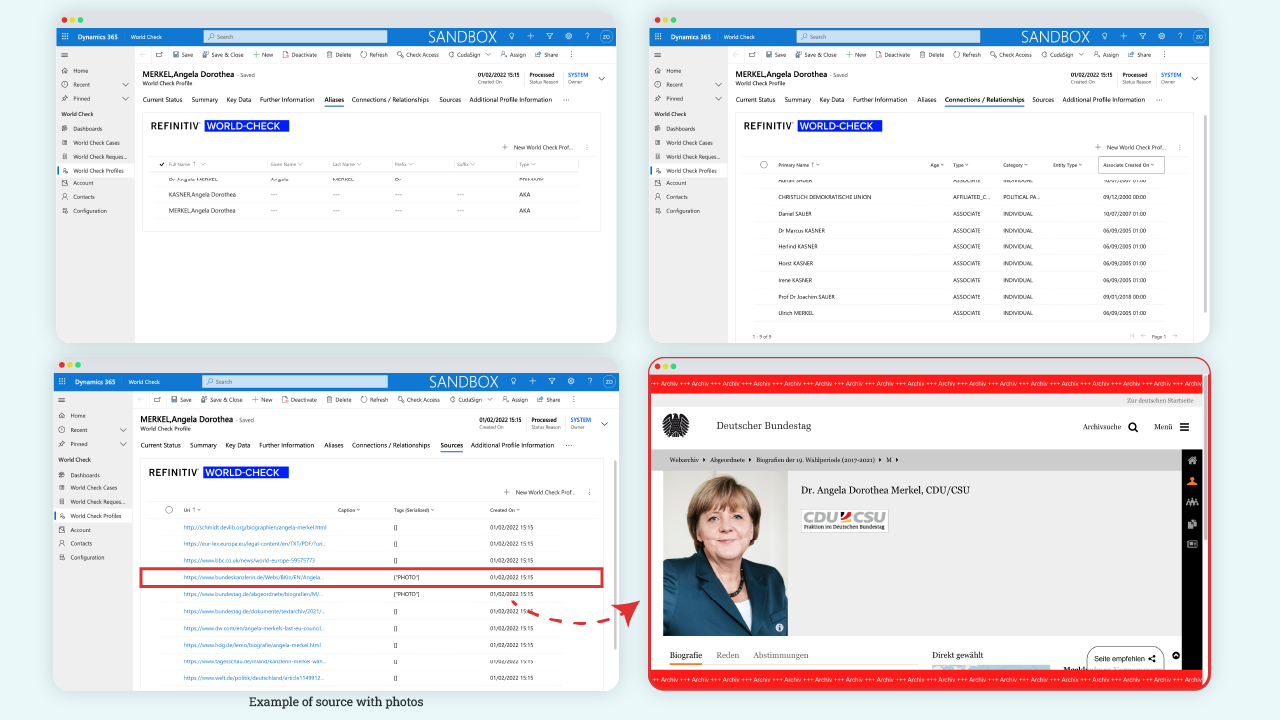

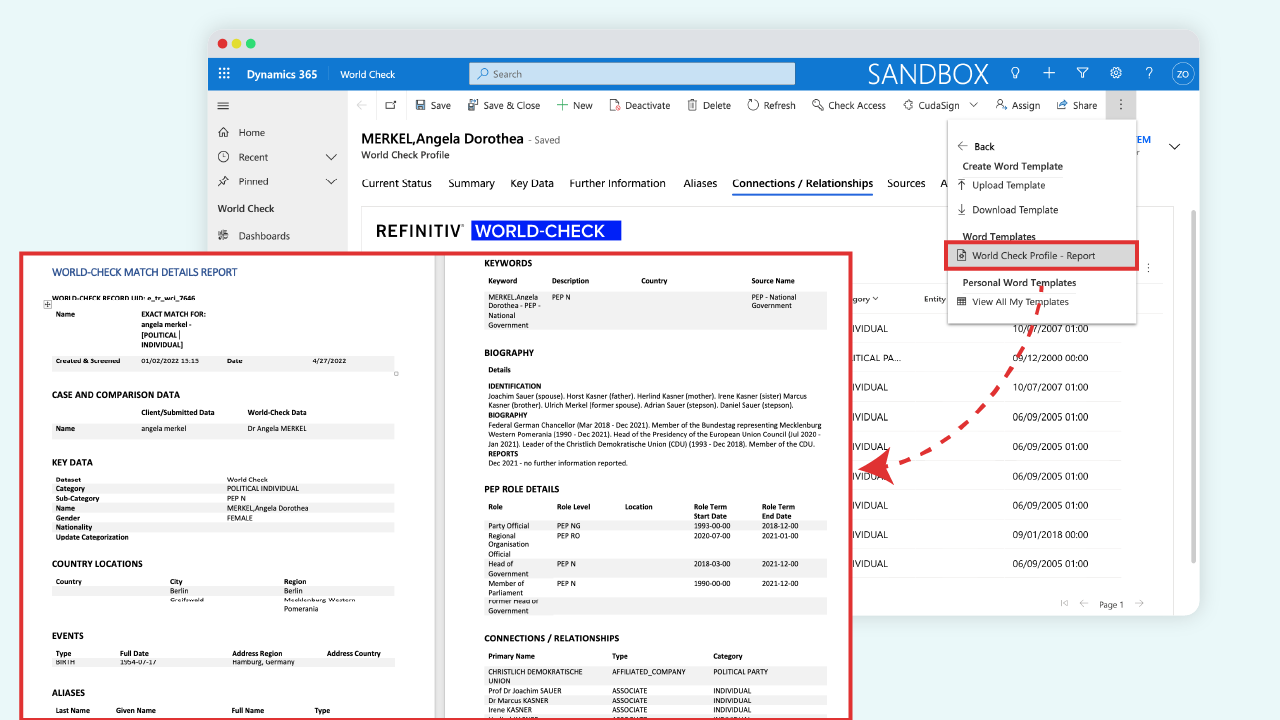

Risk Screening in action

WORLD-CHECK is a registered trademark of Refinitiv or its affiliates

Book a free discovery call today

Complete this short form and we’ll be in touch to arrange an initial chat with you. We’ll discuss your requirements and how Risk Screening can help protect your business against financial crime and enable you to deliver on your due diligence duties.